Trump policies provide tailwinds for industries, with exceptions in Japan

We expect the impact of Trump policies will be a net positive for Japan. The boost from higher import demand due to expansionary fiscal policies will likely overwhelm the adverse impact of targeted tariffs on Japan. The US is Japan’s biggest goods export destination, accounting for 20% of total. Most traded items such as machinery and automotives are set to benefit from higher investment demand and consumer spending.

What you will learn:

- The 30% blanket tariffs on China by the US will also prompt production shifts away from China. Although Japan will not be able to compete with its neighbouring emerging economies on cost in many industries, sectors such as machinery and electronics might reap some benefit.

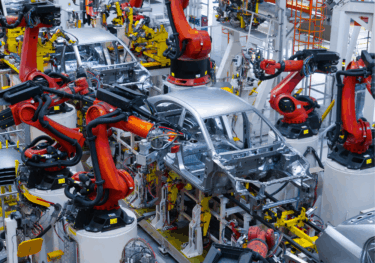

- The machinery sector has a very high potential to benefit from President-elect Trump’s policies given that it is export- and capital-intensive, and Japan has a technological edge in the sector. Protectionism in the US could fuel further protectionist measures in other countries, prompting governments and firms to become more inward-looking and to prioritise localising production, which will also drive demand for machinery.

- In our latest baseline, we expect the automotive and basic metals sectors to be subject to 10% tariffs by the US. Given the commoditised nature of basic metals, Japanese exports to the US will likely decline. However, the US share of Japan’s base metal exports is only 6%, limiting the impact on production. In the case of automotive, it already faces 2.5% tariffs by the US, and consumers’ tastes and preferences for brands and vehicle type should partly work as a buffer.

- High-tech goods, including semiconductors, are also set to benefit as companies look to diversify their supply chains. While back-end processes for chip production like assembly, testing, and packaging are more likely to move to Asian emerging markets such as Vietnam and Malaysia, Japan could benefit from higher demand for front-end processes, where patterns are printed on the wafer. Japanese government’s effort to revive its domestic chip sector, represented by establishment of Rapidus and TSMC’s first Japan plant coming online in 2024, bodes well.

Tags:

Related Posts

Post

Productive sectors remain onshore in Japan amid declining workforces

Amid the continued decline in working-age population, we expect Japan's knowledge-intensive manufacturing sectors will likely outperform other sectors. Machinery, automotive, and chemicals all require specialised know-how that are not easily replicable, and these sectors are striving to boost labour productivity through various forms of investment. The machinery sector will perform particularly well, with its share of manufacturing rising more than 1 ppt by 2035.

Find Out More

Post

Middle East tensions could severely hurt the economy in Japan

Our scenario analysis reveals a partial shutdown of the Strait of Hormuz by Iran would push the Japanese economy into a near-stagflation situation in H2 2025, given Japan's structural vulnerability to terms of trade shocks.

Find Out More

Post

Assessing fiscal risks in advanced economies

For some governments, pressure from markets to set out clearer or more ambitious fiscal plans may build, posing a downside risk to growth in the latter years of this decade.

Find Out More